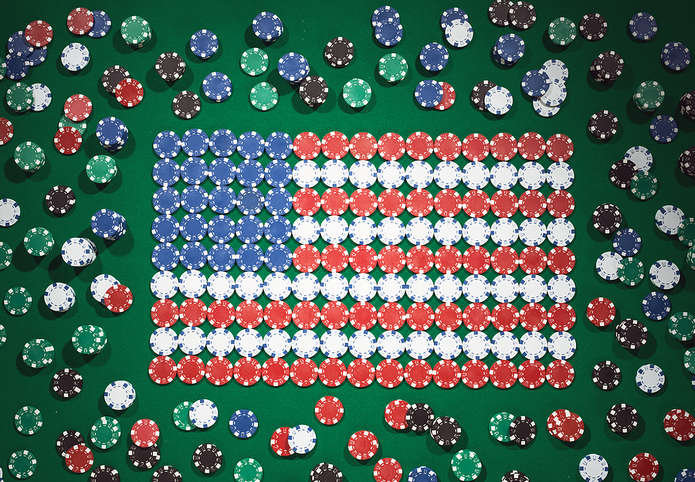

They say that every man has his price, and it seems that every bookmakers can be acquired if you have enough cash too.

They say that every man has his price, and it seems that every bookmakers can be acquired if you have enough cash too.

William Hill has sold up to U.S. casino firm Caesars Entertainment for an eye-popping £2.9 billion – however, Caesars only wants to take the brand forward in the United States, and so their UK presence, including their high street betting shops, will be sold to the highest bidder.

While it won’t necessarily mean any changes immediately if you have an online William Hill account, any buyer will want to stamp their own strategy on the firm – and so the brand may well head in a different direction in the near future.

Will William Hill’s 1,400 betting shops be sold off as part of the venture? That is just one question on the minds of punters right now….

Any Sensible Offer Accepted

In America, the loosening of regulation in the gambling industry is contributing to something of an arms race – mergers and acquisitions seem to be happening every week. William Hill had made decent inroads into the U.S. market, but the outfit lacks the financial clout of some and really was easy pickings for a behemoth like Caesars – even though the casino chain has been hit hard in 2020.

Caesars have been unequivocal: they do not want to take on William Hill’s UK liabilities. And so the brand, founded in 1934 and a bastion of the British high street ever since, is in danger of disappearing for good.

Will anybody take on the risk of those 1,400 betting shops, which employ some 8,000 people? This is a time when the retail betting sector is already taking a hit due to restrictions, closures and the FOBT minimum stake decrease, and the fear is that greater regulation of the gambling industry in the UK is nigh.

The chairman of William Hill, Roger Devlin, said that the board felt that the deal was the ‘best option’ for the firm’s shareholders.

“It recognises the significant progress the William Hill group has made over the last 18 months, as well as the risk and significant investment required to maximise the US opportunity, given intense competition in the US and the potential for regulatory disruption in the UK and Europe,” he confirmed.

As long as 75% or more of William Hill’s shareholders agree to the terms of the deal, the brand will be taken over by Caesars in time for the final quarter of 2020.

Who Will Buy William Hill UK?

Devlin has confirmed that, for the time being at least, it’s ‘very much business as usual’ for William Hill’s shop-based employees, and so punters can continue placing their bets for the foreseeable future.

However, it is likely that at some point soon change will be afoot.

Those in the know claim that is could cost as much as £2 billion to acquire William Hill’s UK assets, but that won’t be enough to put off three potential suitors that are rumoured to be lurking with interest.

Fred and Peter Done, the brains and the wallets behind Betfred, will make a reported £172 million from the sale of William Hill as they were 6% shareholders, but it is believed they will look to cash in further by making a bid for the firm’s UK operations.

That would give the brothers an increased presence on the high street, while there’s the possibility that William Hill’s online customers might be migrated to the Betfred platform if they chose to swallow the Will Hill brand.

That would almost double Betfred’s betting shop portfolio given they currently have 1,500 shops in the UK, and the question is whether the Dones would want to invest in retail betting at a time it is facing its greatest struggle.

Elsewhere, another major concern in the UK gambling industry is reportedly weighing up an offer.

888 Holdings have enjoyed an outstanding 2020 with pre-tax earnings rising by some 130% year-on-year and revenue up to $369 million for the first half of the year. Their chief executive Itai Pazner is considering extending his brand’s portfolio onto the high street with an offer for William Hill’s European assets.

Pazner confirmed his company was ‘in a good position to make acquisitions’, and that the UK stalwart was very much on their radar.

“We are going to look at any asset that can be relevant for us, and within that list, if that opportunity [to buy William Hill’s assets] comes our way that could be relevant for us,” he said.

And there’s a third shark circling in the water, although details of the private equity company linked to a bid for William Hill UK remain sketchy. However, it is believed that current William Hill chief Ulrik Bengtsson is fronting the bid from the mysterious consortium.